Are you considering investing in real estate in the vibrant and ever-growing city of Dubai? Buying off-plan apartments can be a lucrative and exciting opportunity, allowing you to secure a property before it is even completed. However, navigating this process successfully requires careful consideration and informed decision-making. In this guide, we will provide you with valuable tips and insights to help you make the right choices when buying off-plan apartments in Dubai. From understanding the market trends to evaluating developers and assessing potential risks, we have got you covered. So, whether you are a first-time buyer or an experienced investor, read on to discover the essential advice that will empower you to make a smart and rewarding investment in the Dubai property market.

Are you considering investing in off-plan apartments in Dubai? This comprehensive guide will provide you with step-by-step information to help you make an informed decision. Purchasing off-plan properties can be a lucrative investment, but it’s essential to understand the process and consider various factors before making a commitment.

One of the first and most crucial steps in buying off-plan apartments in Dubai is researching the developer. Look for reputable and established developers with a track record of successful projects. Check their previous developments, reviews, and customer feedback to gauge their reliability and quality of work. It’s also important to verify their licenses and credentials to ensure they are authorized to sell properties.

Additionally, pay attention to the financial stability of the developer. A financially stable developer is more likely to complete the project on time and deliver what was promised. Research the developer’s financial standing, including their debt-to-equity ratio and sources of funding. This information will give you an idea of their financial health and ability to complete the project as planned.

Before committing to an off-plan apartment, thoroughly understand the payment plan offered by the developer. Developers in Dubai typically offer flexible payment plans to attract buyers. These payment plans usually involve paying a down payment followed by installments until the completion of the project.

Review the payment schedule and ensure it aligns with your financial capabilities. Consider the frequency and size of the installments and how they will impact your budget. It’s also essential to clarify the consequences of late or missed payments, as some developers may impose penalties or cancel the contract in such cases.

Before signing any agreements or making a payment, carefully review the contract and its terms. Seek legal advice if necessary to ensure you understand all the clauses and potential risks. Pay attention to the completion date, penalties for delays, and any other terms that may affect your investment.

Additionally, review the warranties and guarantees provided by the developer. Understand what is covered under these warranties and the duration for which they are valid. This will give you peace of mind knowing that you are protected in case of any construction defects or issues.

The location of the off-plan apartment plays a significant role in its potential for capital appreciation and rental yield. Research the area and consider factors such as proximity to essential amenities, transportation links, schools, and healthcare facilities. A well-connected and desirable location will attract tenants and increase the chances of a profitable investment.

Additionally, consider the amenities offered within the development itself. Modern facilities such as swimming pools, gyms, landscaped gardens, and security features can enhance the value and appeal of the property. Assess the quality and variety of amenities provided to ensure they meet your expectations.

It’s always advisable to seek professional advice when buying off-plan apartments in Dubai. Consult with a reputable real estate agent or property consultant who specializes in off-plan properties. They can provide insights, market trends, and help you make an informed decision based on your investment goals and budget.

Additionally, consider hiring a lawyer experienced in real estate transactions to review the contracts and ensure your interests are protected. They can assist in identifying any potential risks or loopholes that you may overlook.

In conclusion, buying off-plan apartments in Dubai can be a profitable investment if done with careful consideration and research. Remember to thoroughly research the developer, understand the payment plan, review the contract and terms, consider the location and amenities, and seek professional advice. By following these tips, you can minimize risks and maximize the potential returns on your investment.

Here are some common questions and answers about tips for buying off-plan apartments in Dubai:

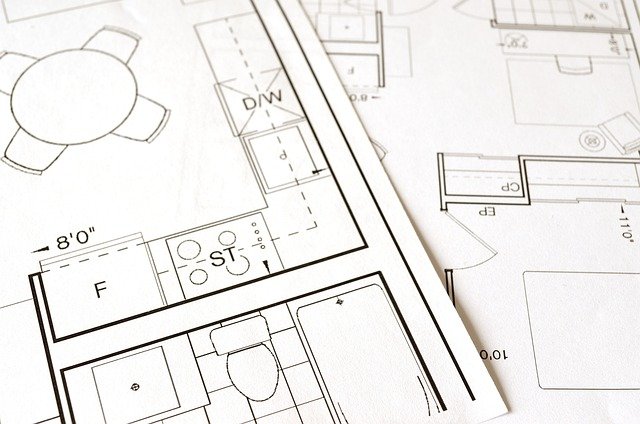

An off-plan apartment refers to a property that is purchased directly from a developer before it is completed. Buyers typically purchase these properties based on floor plans, architectural designs, and other specifications provided by the developer. This means that the apartment may not be physically built at the time of purchase, and buyers are essentially investing in a property that will be constructed in the future.

Off-plan apartments offer the advantage of potentially lower prices compared to ready-to-move-in properties. However, there are also risks involved, such as delays in construction or changes in the final design. It is important for buyers to carefully research the developer’s track record and reputation before making a purchase.

Buying off-plan apartments in Dubai can offer several advantages. Firstly, developers often offer attractive payment plans, allowing buyers to pay in installments over the construction period. This can make it more affordable for individuals who may not have the full purchase amount upfront.

Additionally, off-plan properties have the potential for capital appreciation. As the property is completed and the market value increases, buyers can benefit from the rise in prices. This can be especially advantageous in a growing real estate market like Dubai. Off-plan apartments also give buyers the opportunity to customize certain aspects of the property, such as finishes or layout, according to their preferences.

Before buying an off-plan apartment in Dubai, it is important to thoroughly research the developer and their track record. Look into their previous projects to get an idea of the quality and timeliness of their construction. It is also essential to review the contract and understand the payment plan, as well as any penalties or clauses in case of delays or changes.

Additionally, consider the location of the off-plan apartment and its potential for future growth. Look into the surrounding infrastructure, amenities, and any future development plans in the area. It is also advisable to seek legal and financial advice to ensure a smooth transaction and protect your interests as a buyer.

While buying off-plan apartments can be a lucrative investment, there are also risks involved. Delays in construction are one common risk, which can affect the completion timeline and potentially impact the buyer’s financial plans. Changes in the final design or specifications can also occur, which may differ from what was initially presented to the buyer.

Market fluctuations can also affect the value of the off-plan property. It is important to consider the current real estate market conditions and the likelihood of the property’s value appreciating in the future. Additionally, there is a risk of the developer facing financial difficulties or bankruptcy, which can lead to project cancellations or delays. It is essential to carefully assess the developer’s financial stability before making a purchase.

When buying off-plan apartments in Dubai, it is crucial to understand the legal aspects of the transaction. Make sure to review the sales agreement and contract thoroughly, paying attention to payment terms, completion dates, and any penalties or clauses. It is advisable to seek legal advice to ensure that your rights as a buyer are protected.

Additionally, it is important to verify that the developer has obtained all the necessary approvals and permits for the project. This includes checking if the project is registered with the Real Estate Regulatory Authority (RERA) in Dubai. RERA ensures that developers follow certain regulations and provides a level of protection for buyers. Engaging the services of a reputable and experienced real estate agent can also help navigate the legal aspects of buying off-plan apartments.

In conclusion, buying off-plan apartments in Dubai can be a lucrative investment opportunity, but it requires careful consideration and research. By following the tips mentioned above, such as choosing a reputable developer, understanding the payment plan, and conducting thorough inspections, buyers can navigate the process with confidence and make informed decisions. With Dubai’s booming real estate market and ambitious development projects, investing in off-plan apartments can offer not only a potential high return on investment but also the opportunity to own a modern, luxurious property in one of the world’s most vibrant and cosmopolitan cities.

However, it is important to note that buying off-plan apartments also comes with certain risks, such as project delays or changes in the market conditions. Therefore, it is essential for buyers to stay updated with the latest information and seek professional advice if needed. By approaching the process with caution and diligence, investors can minimize the risks and maximize the rewards of purchasing off-plan apartments in Dubai. Ultimately, with the right strategies and a clear understanding of the market, buying off-plan apartments can be a smart and profitable decision for those looking to invest in Dubai’s thriving real estate sector.