How to Calculate Off-Plan Property Price Hike in the Next 3 Years in Dubai

Dubai, an oasis of architectural marvels and a hub of global commerce, has long been a magnet for property investors. Amidst its skyscrapers and luxurious developments, off-plan properties have gained significant traction among both local and international buyers. These properties, bought directly from developers before construction completion, offer the allure of contemporary designs, modern amenities, and often, more competitive prices.

However, as with any investment, predicting its future value becomes pivotal to maximize returns. In a dynamic market like Dubai, where the real estate landscape is influenced by myriad factors, anticipating price hikes in off-plan properties can be both an art and a science. This guide delves into the intricacies of forecasting the potential rise in prices of off-plan properties in Dubai over the next three years, helping investors make informed decisions and navigate the thriving Dubai real estate market with confidence.

Understanding Off-Plan Property Investments

When embarking on the journey of real estate investment, one term you’ll frequently encounter is “off-plan property.” But what does it truly entail?

1. Definition and Basics:

- Off-plan property refers to properties purchased directly from a developer before its construction is complete. Essentially, buyers invest based on the blueprint, design, and promise of the property.

2. The Allure of Off-Plan Investments:

- Future Value Appreciation: Purchasing at today’s price and selling at tomorrow’s value can lead to significant gains.

- Customization Opportunities: Early buyers often get the chance to customize interiors or choose preferred units.

- Payment Flexibility: Developers frequently offer payment plans that ease the financial burden for investors.

3. Associated Risks:

- Project Delays: Construction delays are not uncommon and can affect the timeline of your investment returns.

- Market Volatility: The future value of property isn’t set in stone; market downturns can influence the anticipated value appreciation.

- Quality Assurance: Since the property isn’t physically present at the time of purchase, there’s a reliance on the developer’s reputation to ensure the finished product matches the promised quality.

4. Why Dubai?

- Robust Infrastructure: Dubai’s commitment to infrastructure and development ensures that most off-plan projects are situated in areas with excellent amenities.

- Investor-friendly Policies: The Emirate’s legal framework and property ownership policies for foreigners make it an attractive destination for global investors.

Factors Affecting Off-Plan Property Prices

When considering the factors that influence off-plan property prices, it’s essential to look beyond just supply and demand, especially in a vibrant real estate market like Dubai.

Firstly, the economic stability of a region plays a pivotal role. As with most investment vehicles, real estate prices are closely tied to the overall health of the economy. In booming economic periods, there’s a surge in buyer confidence which can lead to increased demand for off-plan properties, driving up prices. Conversely, in economic downturns, potential investors might hesitate, leading to stagnation or even a decrease in prices.

Location is another critical factor. Properties in well-connected areas, with proximity to commercial hubs, reputable schools, and healthcare facilities, tend to have higher demand and, consequently, higher prices. Similarly, regions earmarked for future infrastructural developments or those in the vicinity of tourist attractions can also command higher prices due to anticipated future demand.

The reputation of the developer can’t be overlooked. Developers with a track record of timely project completions and high-quality constructions often have higher trust among investors. This trust can lead to a higher demand for their off-plan projects, potentially inflating prices compared to projects from lesser-known developers.

Government regulations and policies can also shape the off-plan property market. In places like Dubai, where the government has a proactive approach to shaping the real estate sector, policies can either incentivize or dissuade investors. For instance, policies that make it easier for foreigners to invest or those that offer residency benefits with property purchases can lead to an influx of foreign investors, driving up demand and prices.

Lastly, global events and their subsequent impact on tourism, trade, and international relations can influence off-plan property prices. Events that put a city or region on the global map can lead to increased foreign investments.

Methods to Predict Price Hikes

Predicting price hikes, especially in a dynamic real estate market like Dubai’s, involves a combination of quantitative analyses and qualitative insights. Here are some methods experts often use:

- Historical Price Trend Analysis: One of the most straightforward approaches is to examine historical price trends. By analyzing the past behavior of off-plan property prices in specific locations or by particular developers, one can often discern patterns that indicate future performance. This method assumes that history, to a certain extent, tends to repeat itself.

- Supply and Demand Forecasting: Evaluating the expected supply of new off-plan properties and contrasting it against the anticipated demand can offer insights into future price movements. If there’s an oversupply predicted but demand remains stagnant or drops, prices may not rise as expected. Conversely, if demand outstrips supply, prices can see a significant uptick.

- Econometric Modeling: This is a more advanced method where economic indicators (like GDP growth, employment rates, and inflation) are used in statistical models to predict property price movements. Such models often factor in local, national, and global economic trends and their potential impact on real estate prices.

- Sentiment Analysis: In the digital age, big data analytics allows for sentiment analysis by gauging public sentiment on social media platforms, forums, and news comments. Positive sentiment around a particular region or a developer can be a precursor to increased demand and subsequent price hikes.

- Infrastructure and Development Plans: Keeping an eye on government and private sector infrastructure and development plans can provide clues. For instance, the announcement of a new metro line, airport, or commercial hub in proximity to an off-plan property project can lead to anticipated price hikes.

- Expert Opinions and Surveys: Real estate experts, analysts, and consultants often provide predictions based on their understanding of the market. Periodic surveys of these experts can offer a consensus view on expected price movements.

- Comparative Market Analysis (CMA): This method involves comparing off-plan properties in question with similar properties that have recently sold or are currently on the market. Factors like location, size, amenities, and developer reputation are considered to anticipate potential price hikes.

Calculating the Predicted Price Hike

When it comes to predicting the price hike of off-plan properties, it’s not just about looking into the future but also quantifying that future value. Here’s a step-by-step guide to help you in calculating the predicted price hike for off-plan properties in Dubai:

- Gather Initial Data: Start by collecting the current prices of the off-plan property you’re interested in. Also, take note of historical price trends, preferably for the last five years or more.

- Apply Historical Growth Rate: Based on historical data, calculate the annual growth rate. For instance, if a property appreciated by 10% over the past year, you could start by applying this percentage to predict the next year’s growth, unless other factors suggest a change in this rate.

- Adjust for Supply and Demand: If there’s data or indications that suggest a potential increase in demand or decrease in supply in the coming years, consider adjusting your projected growth rate upwards. Conversely, adjust downwards if an oversupply or decreased demand is anticipated.

- Factor in Infrastructure and Development: Any upcoming infrastructure projects or major developments can influence property prices. For instance, if a new metro line is announced near your off-plan property, it might justify a higher growth rate.

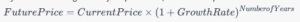

- Use the Compound Interest Formula: Property appreciation compounds over the years. So, if you’re calculating for a 3-year price hike, use the compound interest formula:

- Adjust for Market Sentiment and External Factors: Market sentiment, global economic factors, and local policy changes can all influence property prices. While harder to quantify, they should still play a role in fine-tuning your predictions. For instance, if there’s a general positive sentiment around Dubai’s real estate market, you might consider a slightly higher growth rate.

- Consult Expert Predictions: Once you’ve made your own calculations, compare them with expert predictions and market surveys. If there’s a significant disparity, it might be worth revisiting your assumptions and factors.

- Run Multiple Scenarios: It’s always a good idea to run best-case, worst-case, and most-likely scenarios. This gives you a range and helps you prepare for different potential outcomes.

Potential Challenges & Risks

Investing in off-plan properties in Dubai, as with any real estate investment, comes with its set of challenges and risks. Understanding these can help investors navigate the waters more prudently and make informed decisions:

- Project Delays: One of the most common challenges with off-plan properties is the potential for project delays. Whether due to logistical issues, financial constraints, or other unforeseen challenges, delays can mean a longer wait for property handover, impacting your return on investment timelines.

- Changes in Specifications: Developers might make alterations to the initial plans, leading to a final product that differs from what was initially promised. These changes can range from alterations in layout, finishing quality, to amenities and shared facilities.

- Market Volatility: Dubai’s real estate market, like any other, can be subject to economic fluctuations. A downturn in the market could mean property values drop below purchase prices, leading to potential losses for off-plan investors.

- Regulatory Changes: Dubai’s regulatory framework for real estate has evolved over the years. Changes in property laws, visa regulations, or other government policies can influence the real estate market dynamics, potentially affecting property values.

- Developer Insolvency: On rare occasions, developers might face financial difficulties, leading to halted projects. In such cases, investors risk losing their advances or facing extended project delays.

- Overestimation of Future Value: A critical risk in off-plan investments is overestimating the potential appreciation of the property. If the property does not appreciate as expected, or even depreciates, it can lead to reduced returns or losses.

- Interest Rate Fluctuations: For investors leveraging bank financing, changes in interest rates can impact the cost of the investment. An unexpected rise in interest rates can increase the cost of a mortgage, impacting profitability.

- Unforeseen Construction Challenges: Sometimes, construction projects run into unexpected challenges, be it geological issues, material shortages, or disputes. Such challenges can cause delays or even modifications to the project.

- Reputation and Track Record of the Developer: New or less-established developers might not have a proven track record. Investing with such developers can sometimes be riskier than going with established names in the industry.

- Supply Glut: Dubai has witnessed rapid construction growth, leading to a significant number of properties coming onto the market simultaneously. An oversupply can dampen property prices and rental yields.

- External Factors: Global economic downturns, geopolitical events, or even global health crises can influence property demand and values in the emirate.

Conclusion

Navigating the complexities of off-plan property investments in Dubai can be a rewarding endeavor for those who approach it with diligence, knowledge, and foresight. While the potential for significant returns is undeniable, it’s essential to be aware of the inherent risks and challenges. Predicting price hikes over the next three years or any time frame requires a deep understanding of the multifaceted factors influencing the market, from economic indicators to local regulatory changes. By equipping oneself with the right tools, methodologies, and awareness of potential pitfalls, investors can make informed decisions that optimize their return on investment. In the ever-evolving landscape of Dubai’s real estate market, adaptability, continuous learning, and a strategic approach remain the cornerstones of success. Whether you’re a seasoned investor or a newbie, always remember that every investment opportunity should be met with a mix of enthusiasm, prudence, and thorough research.

![]()