Dubai, the bustling metropolis known for its extravagant architecture and luxurious lifestyle, has long been a hub for off-plan real estate projects. These projects, which involve selling properties before they are completed, have become increasingly popular among investors looking to secure their slice of the Dubai dream. However, as with any investment, there are risks involved, and one of the most pressing concerns in recent years has been off-plan project delays.

In this article, we will delve into the world of off-plan project delays in Dubai, exploring the reasons behind these delays and the impact they can have on investors. From construction setbacks to financial issues, we will shed light on the challenges faced by developers and the measures being taken to mitigate the risks. Whether you are a seasoned investor or someone considering entering the Dubai real estate market, understanding the intricacies of off-plan project delays is crucial to making informed decisions and safeguarding your investments. So, join us as we unravel the complexities of this issue and equip you with the knowledge you need to navigate the Dubai property landscape with confidence.

According to the Dubai Land Department (DLD), the average delay in off-plan project completions in Dubai has been around 12 months over the past five years. However, the delay has varied depending on the project and the developer. Some projects have been delayed by only a few months, while others have been delayed by several years.

Financial problems: Developers may experience financial problems, which can make it difficult for them to complete projects on time.

Government approvals: Developers may need to obtain a variety of government approvals before they can start construction or complete a project. This process can be time-consuming and can lead to delays.

Construction challenges: Dubai has a harsh climate, which can make construction challenging. Additionally, the city is rapidly expanding, which can put a strain on resources and lead to delays.

The DLD has taken a number of steps to reduce the number of off-plan project delays in Dubai. For example, the DLD has implemented a new escrow system that requires developers to deposit all buyer payments into an escrow account. This helps to protect buyers in the event that a project is delayed or abandoned.

Despite the recent statistics, it is important to note that not all off-plan projects in Dubai are delayed. Many developers have a good track record of completing projects on time. However, it is important to do your research and choose a reputable developer before investing in any off-plan property.

Check the developer’s track record. Look at the developer’s previous projects and see if they have been completed on time and within budget.

Read the fine print. Before you sign any contract, read the fine print carefully to understand the terms of the payment plan, any interest that may be charged, and any penalties that may apply if you default on your payments.

Get legal advice. It is always a good idea to get legal advice before investing in any off-plan property. A lawyer can review the contract and advise you on any potential risks.

Off-plan project delays in Dubai can be frustrating for property buyers. It is important to stay informed about the factors that can cause delays and how to navigate through them. Some common reasons for delays include changes in regulations, funding issues, and construction challenges. Buyers should research the developer’s track record and reputation before investing. It is also advisable to have a contingency plan in case of delays, such as a temporary rental or alternative investment options.

Investing in off-plan projects in Dubai can be an exciting opportunity to own a property in one of the most dynamic real estate markets in the world. However, it’s important to be aware of the potential delays that may occur during the development process. Understanding these delays and how to navigate through them can help you make informed decisions and manage your expectations.

Before investing in an off-plan project, it’s crucial to conduct thorough research on the developer and the project itself. Start by reviewing the developer’s track record and reputation. Look for any past delays or issues they may have faced in completing their projects. Additionally, research the specific project you’re interested in. Find out if there have been any reported delays or if there are any ongoing legal disputes that could impact the development timeline.

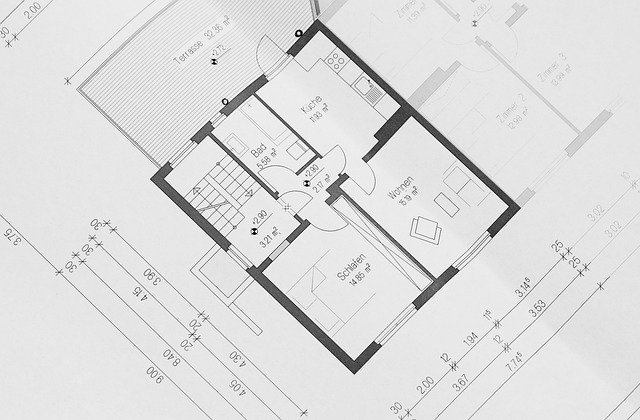

Furthermore, consider the location of the project and its potential impact on the development process. Factors like regulatory approvals, infrastructure development, and access to utilities can all affect the timeline of the project. By conducting comprehensive research, you’ll have a better understanding of the potential risks and delays associated with the off-plan project.

Once you’ve selected an off-plan project, it’s important to have a clear understanding of the development timeline. Developers typically provide an estimated completion date, but it’s crucial to remember that this is only an estimate and delays can occur. Familiarize yourself with the various stages of the development process, such as obtaining permits, securing financing, and completing construction. This will help you anticipate potential delays and manage your expectations accordingly.

Additionally, communicate with the developer or their representatives to gain insights into the progress of the project. Regular updates can help you stay informed about any changes or delays that may arise. By understanding the development timeline and staying in touch with the developer, you’ll be better prepared to navigate through any unexpected delays.

If you encounter significant delays with your off-plan project, it may be necessary to seek legal advice. Engaging a reputable real estate lawyer who specializes in off-plan projects can help protect your rights and interests. They can review your contract, assess the developer’s obligations, and provide guidance on the legal options available to you.

Remember to keep all documentation and communication related to the project, as this will be crucial if you need to escalate the matter legally. A legal professional can work with you to negotiate a resolution, whether it’s seeking compensation, requesting a refund, or exploring alternative options.

Lastly, it’s important to stay informed and flexible throughout the entire process. Real estate markets are dynamic, and unexpected events or changes in regulations can impact off-plan projects. By staying updated on market trends and industry news, you’ll be better equipped to anticipate potential delays and adjust your plans accordingly.

Additionally, remain flexible with your investment strategy. If you encounter significant delays or other unforeseen challenges, consider alternative options such as selling your off-plan property or exploring different investment opportunities. Being adaptable will help you navigate through any delays and make the most out of your investment in the Dubai real estate market.

Here are some commonly asked questions about off-plan project delays in Dubai:

Off-plan project delays refer to the postponement or extension of the completion date for a property development that is purchased before construction is completed. These delays can occur due to various factors such as construction issues, legal challenges, financial difficulties, or changes in market conditions.

Developers may encounter unexpected obstacles during the construction process, which can lead to project delays. It is important for buyers to be aware of these potential delays and understand the implications they may have on their investment.

There are several common reasons for off-plan project delays in Dubai. These include:

a) Construction challenges: Delays can occur due to unforeseen technical difficulties, shortage of construction materials, or changes in design or specifications.

b) Legal and regulatory issues: Projects may face delays if they encounter legal disputes, permit or licensing delays, or changes in regulations that affect the development process.

c) Financial constraints: Developers may face financial challenges that impact their ability to complete the project on time, such as difficulties in securing funding or economic downturns.

d) Market conditions: Changes in market demand or investor sentiment can also lead to delays, as developers may need to reassess their plans or adjust their strategies to align with market conditions.

If a buyer’s off-plan project is delayed, it is recommended to take the following steps:

a) Stay informed: Keep in touch with the developer or their representatives to stay updated on the progress of the project and any changes in the completion timeline.

b) Seek legal advice: Consult with a legal professional who specializes in real estate to understand your rights and obligations as a buyer. They can guide you on the necessary steps to take in case of delays or breaches of contract.

c) Consider alternative options: Evaluate the feasibility of alternative accommodation or investment options in case the delay significantly impacts your plans or financial situation.

d) Communicate with other buyers: Join forums or groups where other buyers of the same project discuss their experiences and share information. This can provide valuable insights and support during the delay period.

Buyers may be entitled to compensation for off-plan project delays in Dubai, depending on the terms and conditions outlined in the sale and purchase agreement. It is important to review the contract and understand the provisions related to delays, penalties, and compensation.

If the developer fails to meet the agreed-upon completion date without valid reasons, buyers may have grounds to seek compensation. However, the specific legal remedies and processes may vary depending on the circumstances and applicable laws. Seeking legal advice is recommended to understand the options available for seeking compensation.

To protect themselves from off-plan project delays, buyers can take the following precautions:

a) Research the developer’s track record: Prior to purchasing an off-plan property, conduct thorough research on the developer’s reputation, track record, and history of delivering projects on time.

b) Review the contract carefully: Pay close attention to the terms and conditions related to project completion and potential delays. Seek legal advice to ensure that the contract provides adequate protections for buyers.

c) Consider project escrow accounts: Ensure that the developer has established a project escrow account, where funds are held separately and released in accordance with the construction progress. This can provide an added layer of protection for buyers.

d) Stay informed and proactive: Regularly communicate with the developer, attend project updates or progress meetings, and stay informed about any changes or challenges that may affect the completion timeline.

In conclusion, the issue of off-plan project delays in Dubai is a complex and concerning one. While the city’s real estate market offers great opportunities for investors, it is crucial to be aware of the potential risks and challenges associated with off-plan projects. By understanding the factors that contribute to these delays, such as financing issues, regulatory hurdles, and market fluctuations, investors can make informed decisions and mitigate their risks.

Furthermore, it is important for developers and regulatory authorities to work together to address this issue and ensure timely completion of off-plan projects. Implementing stricter regulations, improving transparency, and establishing clear guidelines for developers can help enhance investor confidence and protect their interests. Ultimately, a collaborative effort is needed to create a more stable and reliable real estate market in Dubai, where off-plan projects can be successfully delivered and contribute to the city’s growth and development.